Advantages of Royalty Interest Ownership

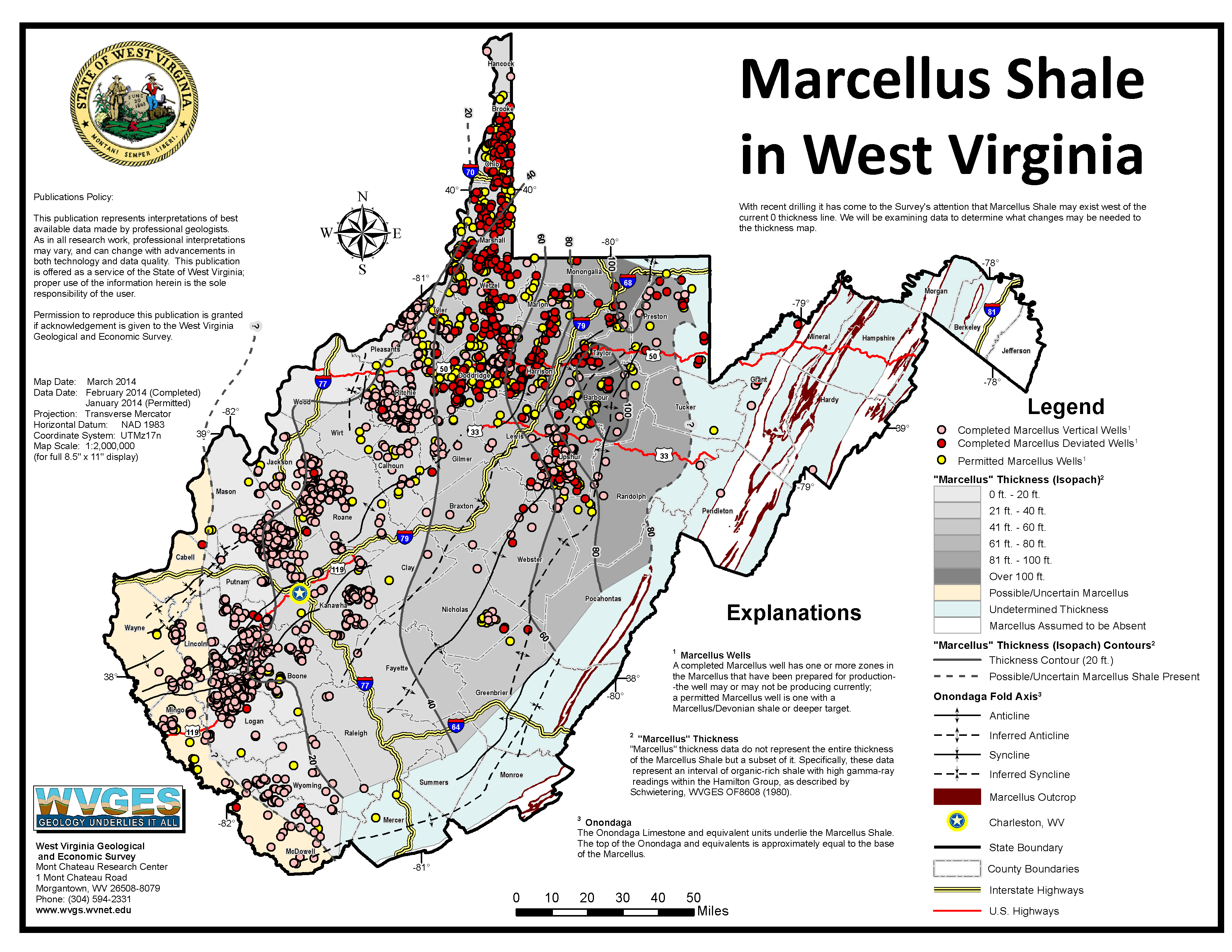

- EQT (NYSE: EQT), is the Joint Venture owner and operator and natural gas purchaser of the acreage. The company holds a concentrated acreage position in the core of the Marcellus Shale consisting of over a million net acres. It’s a position EQT used to fuel a compound annual production growth rate of 31% since it started developing the Marcellus Shale in 2009. Despite that rapid rise, EQT still has plenty of room for growth. The company estimates that 18 trillion cubic feet of resource potential underlie its position. EQT is the largest producer of natural gas in the United States.

- Black Diamond Minerals acquired net mineral acres in the Appalachia basin in Marshall County, West Virginia. This county is the #1 producing county in West Virginia. Tug Hill Operating, LLC was the operator and the oil, natural gas, and LNG purchaser of the 6 wells on the property. EQT acquired Tug Hill earlier this year. The company plans to continue to grow in this area through select strategic acquisitions and grassroots leasing efforts. Their focus is on operational excellence and detailed analysis, with all decisions underpinned by deep technical and financial evaluation.

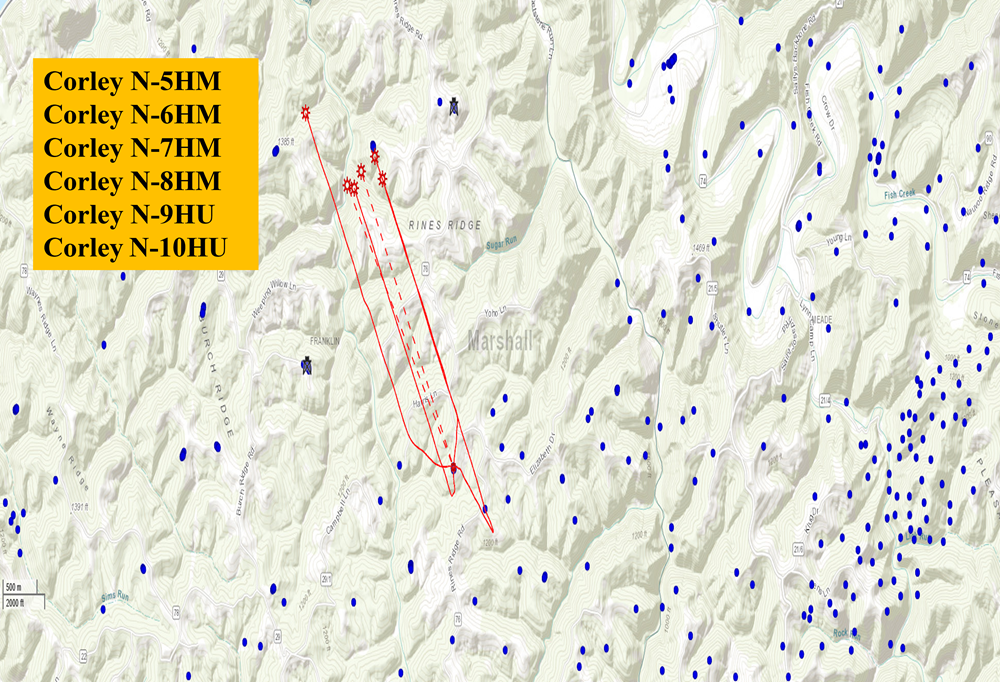

- The property has 6 wells producing on the acreage at this moment and there is still a lot more room to drill additional wells (assets) on the net mineral acres. On production, the Corley N 5-8HM wells are averaging 316,611.29 MMCF/month, 20,238.10 Barrels NGL/month, and 2,758 BO/month. The Corley N-9HU well is averaging 136,563.42 MMCF/month, and the Corley N-10HU wells is averaging 139,044.65 MMCF/month. This acreage is in the wet gas area of the Marcellus Shale which is why four of the wells produce oil, gas, and LNG.

- Operators in the Marcellus Shale formation are now beginning to drill deeper and are producing the Utica Formation (12,500 feet from surface) which could be another passive income opportunity for the future on the net mineral acres if the operator decides to develop the formation in the future. The Corley N-5-8HM, Corley N-9HU, and the Corley N-10HU wells were put into production in 2019. Also, there are no gathering fee deductions on gas production in Marshall County. The biggest benefit on this acreage is there is still availability to drill additional Marcellus Shale horizontal wells in the future which is no cost to the mineral interest and royalty interest owner and with drilling success will increase the monthly cash flow of the property.

- A horizontal well can be fracked 3 times throughout its life which extends the life of the well and the reserves to be produced. Once EQT makes the decision to re-enter the wells and frack for the 2nd time and 3rd time, this is no cost to the royalty interest owner and could dramatically increase the monthly and annual return as well as the production lives of the wells.

- With no additional fracking, the wells could have a 40+ year life span which generates a monthly return for many decades.

- As oil, natural gas, and LNG continues to increase in price, the passive income from the producing wells increases.

- Diversification in royalty interest gives your portfolio more stability and passive income and creates another strong investment in your portfolio without putting you in a risky situation for the monthly and yearly passive income for decades.